So-sure

the story

Dylan Bourguignon believes that insurance should be fair. He believes in win-win solutions that benefit both companies and the consumers they serve. After ten years of working in a private equity firm specialised in finding and financing new insurance solutions, Dylan still wasn’t able to find a flexible, user-friendly insurance solution that puts its customers first without endangering the company’s business model or underwriters. He therefore quit his job and decided to invent the ideal win-win insurance solution himself.

Launched in 2016, SO-SURE is a UK based insurtech that started out by providing insurance cover for what could be considered the most important and the most used item of the 21st Century: the mobile phone.

SO-SURE provides quick and easy insurance for phone owners from all walks of life and ages. And whether you have a tendency to drop and break your phone, leave it in the taxi, pub, or the tube, or if you just can’t quite remember where you left it, SoSure has got you covered.

SO-SURE’s mission? Restore both people’s phones and their trust in insurance. Sounds like quite a task, doesn’t it? Here’s how they go about it.

Introducing SO-SURE

SO-SURE is an online insurance platform and app. Originally only offering mobile phone insurance, SO-SURE has just launched a new home contents insurance offer.

For mobile phone insurance, registering on SO-SURE the platform is quick and easy. You just tap in some details and in a few minutes, your phone is covered for loss, damage, out-of-warranty breakdowns, and even international travel. Unlike others, they can also insure any phone new, refurbished, second hand. Prices range from around £3 to up to £13 per month for the very latest and most expensive phone models, which still makes SO-SURE up to 40% cheaper than other insurers.

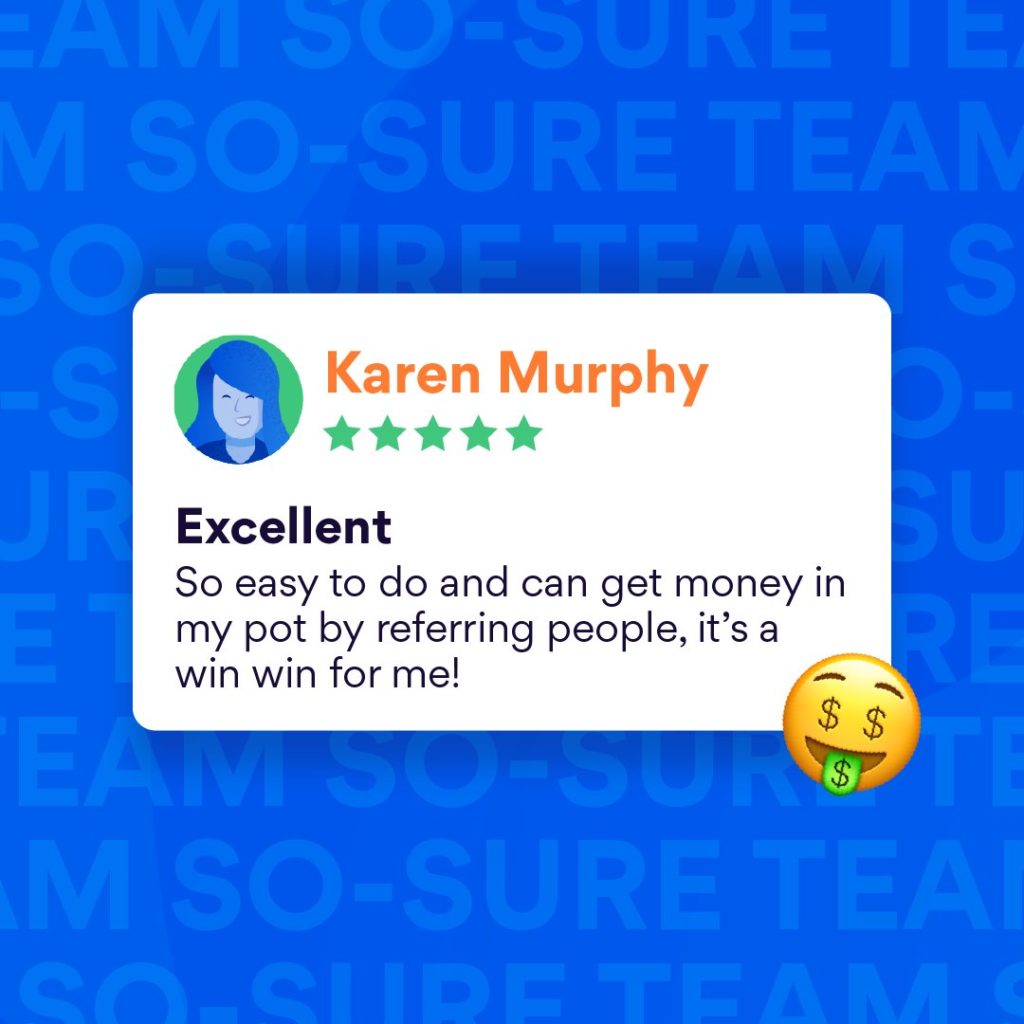

If your phone gets damaged, lost or stolen, making a claim is also very simple. SO-SURE has a friendly-claims team that will deal with the claim and get a replacement phone or your repaired phone back to you within 72 hours. If you and your friends/family don’t make a claim, you can get up to 80% of your premium back, every year.

SO-SURE’s just-launched-last-month home contents insurance covers all objects inside your home. It’s also cheaper than traditional offers and unique in so far as you can get 40% money back, every year, when you and your friends/family don’t claim.

Unlike registering with traditional home contents insurers which tends to require vast amounts of forms and painful claim processes, SO-SURE uses augmented reality to detect, record and price objects. You simply film the objects you want to insure and fill in the serial numbers thus creating your own online inventory. All your information is stored in your account, meaning that you don’t have to go hunting around for serial numbers or proof of purchase if you need to make a claim. The app aims for 100 % transparency informing users of the amounts they are likely to receive if objects are damaged or stolen. For the underwriters, this is a system that greatly decreases unnecessary losses as it makes things far more complex for would-be fraudsters.

Why SO-SURE ?

Traditional insurance is often costly, time-consuming to subscribe to and slow to react to claims or make payouts. SO-SURE’s solution therefore solves a major pain point for consumers essentially reinventing insurance making it fairer, easier and far more consumer-centric. SO-SURE makes a point of listening to its customers. Their home insurance offer was actually launched upon request from their mobile phone insurance holders. For Breega, this is the consumer insurance solution that up until now has been missing. Isabelle Gallo, Breega Partner and SO-SURE Board member says:

“What I really like about SO-SURE is that they’ve been able to demonstrate that insurance can be fair to the customer as well as the carrier, thanks to tech.Their system can detect fraudsters at different stages of the user journey which in turn benefits non-fraudster users by passing cost savings onto them”.

Why Breega ?

Breega is SO-SURE’s first VC investor. Dylan says that he chose to work with Breega because he liked our down-to-earth entrepreneurial approach and the active role we play in helping our companies grow.

“Isabelle is a big help on the Board, she always speaks her mind and gives sound and actionable advice, she’s like an extension of the team”.

He goes on to say:

“Breega’s Ops team is also a big help, the HR squad has helped us source and recruit for key positions and the whole team is always on hand to discuss and provide useful tips and information”.

So what’s next for this pioneer of social insurance?

SO-SURE is doing well. With over 30 000 loyal customers and growing, the company is expecting to experience rapid growth over the coming months. Dylan plans to expand SO-SURE’s range of services and their customer base into Europe – where current consumer insurance players are in need of some disruption – and is in the process of forming some exciting European partnerships.

With major growth and European expansion on the books, SO-SURE is hoping to bring their win-win insurance solution to all. Breega would say with their talent, team and attractive customer-centric solutions, they’ve got it covered 🙂